GST Course in Hyderabad

- Expert Trainer with 18+ years expertise

- Mock Interviews and Interview Questions

- Lifetime Access to Learning Management System (LMS)

- 100% Placements Assistance with Certificate and Career Guidance

Table of Contents

ToggleGST Course in Hyderabad

Batch Details

| Trainer Name | Mr. Varun Kumar |

| Trainer Experience | 18+ Years |

| Next Batch Date | 05th Feb 2024 (9:00 AM IST) |

| Training Modes | Online Training (Instructor Led) |

| Course Duration | 45 Days |

| Call us at | +91 96034 33444 |

| Email Us at | |

| Demo Class Details | Click here to chat on WhatsApp |

GST Course in Hyderabad

Curriculum

- Overview of GST

- Historical context and evolution of GST

- Objectives and benefits of GST implementation

- Comparison between GST and previous tax systems

- Understanding the GST framework in India

- Components of GST: CGST, SGST, IGST

- GST rates and classifications

- Input Tax Credit (ITC) mechanism

- Mandatory and voluntary GST registration

- Eligibility criteria for registration

- Procedure for GST registration

- Compliance requirements under GST: filing returns, payment of taxes, etc.

- Importance of GST-compliant invoicing

- Format and details of a GST invoice

- Documentation requirements under GST

- Common mistakes and best practices in invoice preparation

- Calculation of GST liability: Output tax, Input tax

- Accounting treatment of GST transactions

- Impact of GST on financial statements

- Case studies and practical examples

- Understanding GST audits and assessments

- Preparation for GST audits

- Handling GST assessment notices

- Resolving disputes and appeals under GST

- GST implications on exports and imports

- GST compliance for E-commerce transactions

- Reverse charge mechanism (RCM) under GST

- Special provisions for specific industries or sectors

- Latest updates and amendments to GST laws

- Impact of recent court rulings on GST

- Proposed changes in GST regulations and their implications

- Understanding GST implications on import-export transactions

- Documentation and compliance requirements for international trade under GST

- Treatment of GST on goods and services imported/exported under various schemes (e.g., SEZ, EOU)

- Handling GST on cross-border transactions and related challenges

- Maximizing benefits of Input Tax Credit (ITC) under GST

- Eligibility criteria for claiming ITC

- Documentation and record-keeping for ITC reconciliation

- Strategies to mitigate risks and challenges in claiming ITC

- Specific GST compliance requirements for industries such as real estate, construction, hospitality, etc.

- Understanding sector-specific exemptions, thresholds, and notifications

- Case studies and examples tailored to the challenges faced by special industries under GST

- Leveraging technology for seamless GST compliance

- Overview of GST compliance software and tools

- Integration of accounting systems with GSTN (Goods and Services Tax Network)

- Automation of GST processes for efficiency and accuracy

- Understanding the GST audit process in-depth

- Handling GST audit queries and documentation requests

- Managing investigations and inquiries by GST authorities

- Strategies for minimizing risks and penalties in GST audits

- Analyzing real-life GST scenarios

- Workshop sessions on GST compliance software/tools

- Group discussions and problem-solving exercises

- Review of key concepts covered in the course

- Preparing for the GST certification exam

- Conclusion and next steps in mastering GST compliance

GST Course in Hyderabad

Key Points

Hands-On Projects

Practice real-world GST situations, like preparing invoices, calculating taxes, and ensuring compliance with regulations. Apply theoretical knowledge to practical situations through case studies and simulation exercises, improving proficiency in GST implementation.

Mock Interviews

Participate in interview sessions designed specifically for GST positions, which helps improve communication and problem-solving skills. Receive valuable feedback from industry experts to better prepare for actual job interviews in the GST field.

Guidance from Mentors

Benefit from personalized mentorship from expert professionals in the GST domain, offering insights, advice, and career guidance. Access mentor support for clarifying doubts, discussing complex concepts, and receiving valuable industry perspectives throughout the course.

Resume Building Support

Get help creating a strong resume for GST jobs, focusing on your important skills, work experience, and any certifications you have . Gain valuable information into industry expectations and best practices for resume formatting and content to increase visibility to potential employers.

Flexible Learning Choices

Access course materials and resources online at your convenience, enabling self-paced course learning to accommodate busy schedules. Choose from flexible learning formats, including live sessions, recorded lectures, and interactive discussions, to suit individual learning preferences..

Expert-Led Training

Learn from industry experts with extensive experience in GST compliance, taxation laws, and accounting practices. Benefit from the expertise of seasoned professionals who provide practical insights, real-world examples, and in-depth knowledge to enrich the learning experience.

What is GST?

GST stands for Goods and Services Tax. It is a comprehensive indirect tax levied on the supply of goods and services in India. GST has replaced multiple indirect taxes like the Central Excise Duty, Service Tax, Value Added Tax (VAT), and others. The implementation of GST aims to simplify the taxation system, eliminate Streaming effects (tax on tax), and create a unified and transparent tax structure.

GST is a destination-based tax, meaning it is levied at the point of consumption. It is categorized into Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST) for inter-state transactions. The GST system ensures that the tax burden is shared between the central and state governments, promoting a more equitable distribution of tax revenue.

Businesses and individuals are required to register under GST if their aggregate turnover crosses a specified threshold. GST has different slabs for various goods and services, ranging from 0% to 28%, and it has played a significant role in simplifying the tax structure and promoting a more uniform tax regime in India.

GST Course in Hyderabad

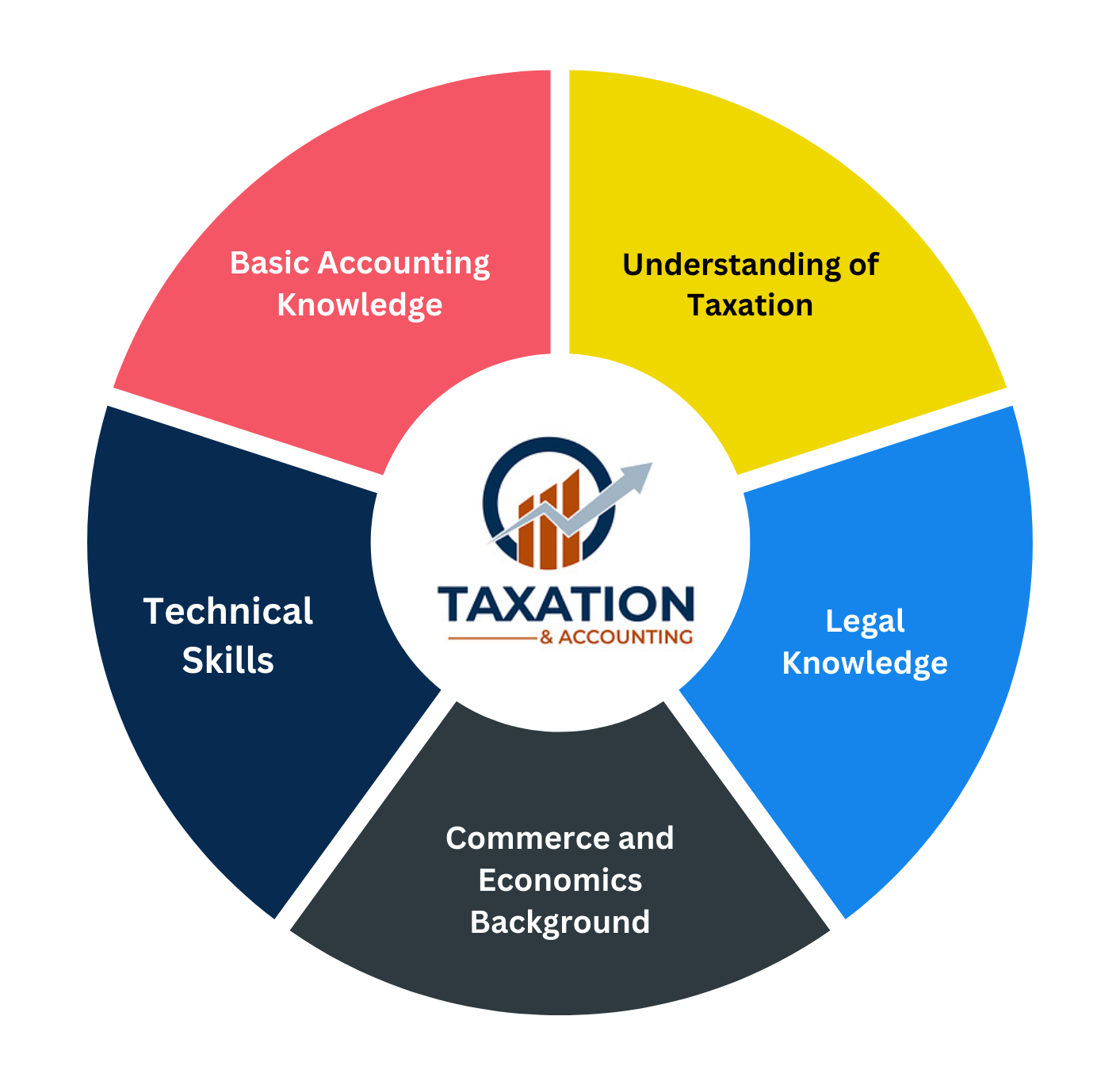

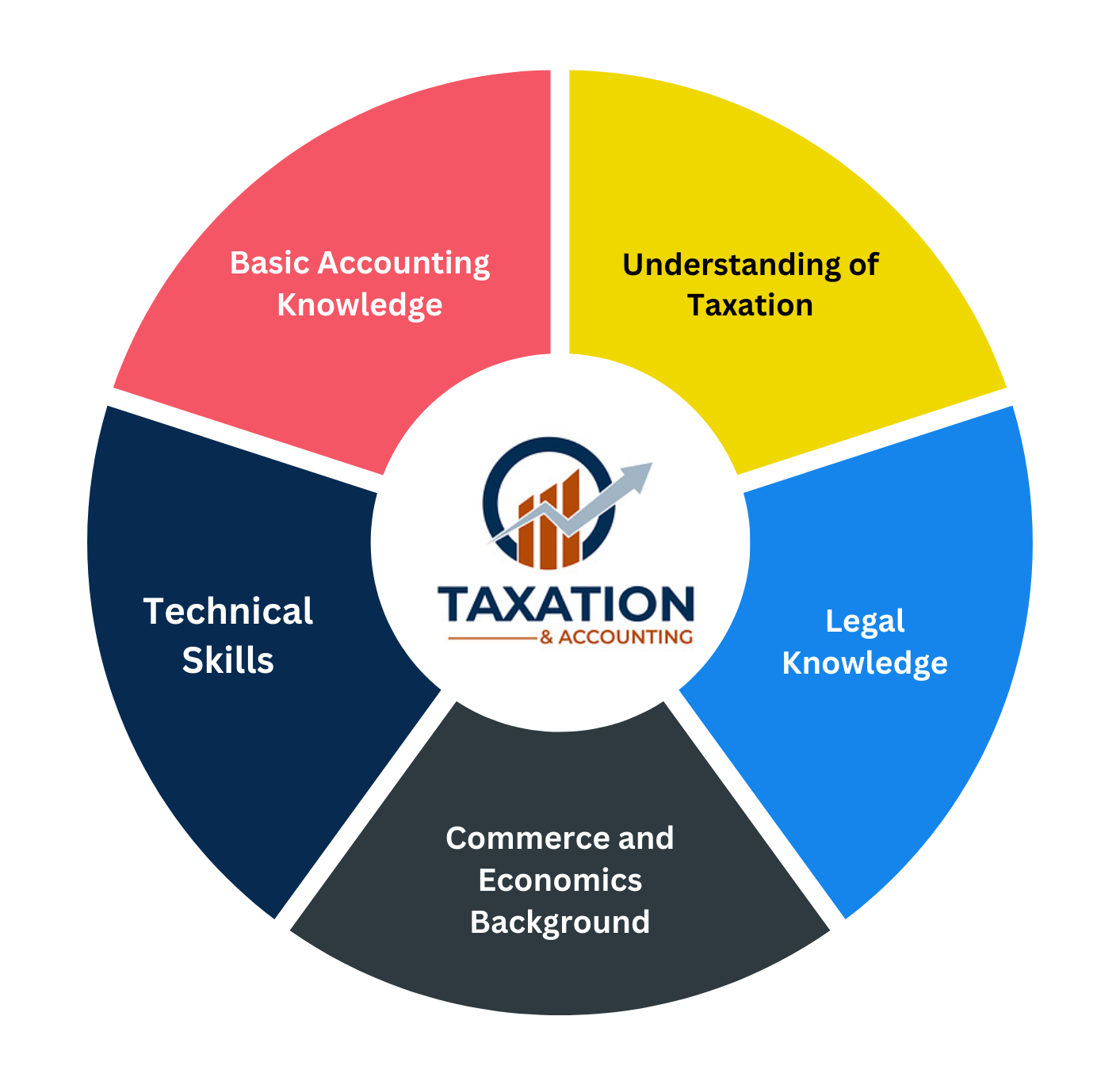

Pre-Requisites

- Basic Understanding of Taxation: Awareness with the fundamentals of taxation, including types of taxes (direct and indirect), tax structures, and tax principles, provides a solid foundation for grasping GST concepts.

- Knowledge of Accounting Principles: Understanding basic accounting principles such as debits and credits, financial statements, and accounting entries helps in comprehending GST accounting treatment and its impact on financial reporting.

- Awareness of Business Operations: A general understanding of how businesses operate, including sales, purchases, inventory management, and financial transactions, provides context for learning about GST compliance requirements and implications on business operations.

- Proficiency in Numerical Skills: Good numerical skills are essential for calculating GST liabilities, input tax credits, and other tax-related computations accurately.

- Computer Literacy: Since GST compliance involves online registration, filing returns, and using GSTN (Goods and Services Tax Network) portal, proficiency in using computers and navigating online platforms is beneficial.

GST Course in Hyderabad

Course Outline

GST course in Hyderabad provides a comprehensive understanding of Goods and Services Tax. The GST course at Accounting Mastery is suitable for finance professionals, business owners, students, and anyone interested in understanding GST comprehensively. With our comprehensive GST training course you will learn fundamental skills as well advanced concepts such as –

01

Introduction to GST

Understand the fundamentals of Goods and Services Tax (GST), including its objectives and historical context.

02

GST Framework and Structure

Learn about the dual structure of GST comprising Central GST (CGST) and State GST (SGST), along with its components and rates.

03

GST Registration and Compliance

Explore the process and requirements for GST registration and compliance, including eligibility criteria and filing returns.

04

GST Invoice and Documentation

Gain a comprehensive understanding of GST-compliant invoicing, documentation requirements, and best practices.

05

GST Calculations and Accounting

Learn how to calculate GST liabilities, manage Input Tax Credit (ITC), and handle GST accounting entries.

06

GST Audit and Assessment

Understand the GST audit process, preparation for audits, and resolution of disputes.

07

GST Compliance for Special Transactions

Explore GST implications for exports, imports, e-commerce, and special industries.

08

GST Updates and Recent Changes

Stay updated on the latest amendments, notifications, and changes in GST laws and regulations.

09

GST Case Studies and Workshops

Apply theoretical knowledge to practical Circumstances through case studies, workshops, and problem-solving exercises.

GST Course in Hyderabad

Couse Overview

At Accounting Mastery, GST course in Hyderabad offers a comprehensive exploration of Goods and Services Tax, designed for individuals seeking in-depth knowledge of this transformative taxation system. The course begins with an insightful introduction, providing a historical context and foundational understanding of GST’s key role in the economy..

Our training includes case studies, examples, and real business situations integrated to improve understanding and application of theoretical concepts of GST with ease. Our course concludes with a summarization of key learnings of future trends in GST, and an overview of potential career opportunities in this dynamic field.

Upon successful completion of the course, participants will receive a certification from Accounting Mastery, recognizing their expertise in GST principles, compliance, and practical application. This course is ideal for accounting professionals, finance professionals, tax practitioners, business owners, entrepreneurs, and anyone seeking to enhance their knowledge and skills in GST compliance and taxation.

The Comprehensive GST Mastery course offered by Accounting Mastery is designed to provide participants with a thorough understanding of Goods and Services Tax (GST) principles, compliance requirements, and practical applications.

Join us today and start on your journey to mastering Goods and Services Tax with Accounting Mastery’s Comprehensive GST Mastery course.

Modes Of Training

Classroom Training

- Experienced Professional Instructors

- Personalized Guidance

- Interactive Learning Environment

- Practical Learning Approach

- Mock Interviews & Career Guidance

Online Training

- Experienced Professional Instructors

- Personalized Guidance

- Tailored for Remote Learning

- Practical Learning Approach

- Mock Interviews & Career Guidance

Self-paced Video Training

- Structured Live Recordings

- Personalized Guidance

- Interactive Weekly Online Sessions

- Practical Learning Approach

- Mock Interviews & Career Guidance

GST Course in Hyderabad

Career Opportunities

As the GST Course in Hyderabad framework evolves and businesses continue to change, the demand for skilled professionals in GST-related roles is likely to grow. Individuals with expertise in GST compliance, analysis, and strategic planning will find sample opportunities in the ever-changing taxation environment. The field of Goods and Services Tax (GST) offers a range of career opportunities across various industries. Here are some potential career paths and opportunities in GST:

01

GST Consultant

Provide expert guidance and consultancy services to businesses on GST compliance, implementation strategies, and tax planning.

02

GST Analyst

Analyze GST regulations, interpret changes, and assess their impact on businesses, helping organizations stay compliant and optimize tax efficiencies.

03

Tax Accountant:

Specialize in GST accounting, including preparation of GST returns, reconciliations, and compliance reporting for businesses across industries.

04

Tax Manager

Oversee GST compliance efforts within organizations, ensuring adherence to regulations, managing audits, and implementing strategies to minimize tax risks.

05

Indirect Tax Manager

Lead the indirect tax function, including GST compliance, planning, and risk management, while staying aware of regulatory developments.

06

Audit Manager

Conduct GST audits, assess compliance levels, identify areas of improvement, and provide recommendations to improve processes and reduce risks.

07

Tax Technology Specialist

Utilize technology tools and systems for GST compliance, including implementation of GST software, automation of tax processes, and data analysis.

08

Freelance/Consulting

Work independently as a freelance GST consultant, offering specialized services to businesses, startups, or individuals seeking assistance with GST compliance, planning, or advisory services.

09

Corporate Trainer

Share knowledge and expertise in GST through teaching, training, or academic roles in educational institutions, professional training organizations, or corporate training programs.

10

Legal Advisor

Offer legal counsel on GST matters, including interpretation of tax laws, dispute resolution, and representation in tax legal cases.

GST Course in Hyderabad

Certifications

With our comprehensive GST certification course students will learn from real business situations and projects, which is great for their job skills.

Upon successfully completing the GST course at AccountingMastery, students will receive a Course Completion Certificate in GST.

Our comprehensive GST training is an all-inclusive package suitable for individuals aspiring to secure employment or undertaking into the field of GST.

Testimonials

GST Course in Hyderabad

Benefits

Learning Goods and Services Tax (GST) can offer several benefits, including:

Enhanced Career Opportunities

Acquiring GST knowledge opens up opportunities in taxation, accounting, and related fields, making you a valuable asset to employers.

Improved Business Understanding

For entrepreneurs and business owners, understanding GST is crucial for compliance, tax planning, and efficient financial management.

Legal Compliance

Learning GST ensures that individuals and businesses comply with tax regulations, reducing the risk of legal issues and penalties.

Career Advancement

Employees with GST expertise often find it easier to advance in their careers, taking on roles with greater responsibilities.

Entrepreneurial Skills

Entrepreneurs have the ability to handle their business's tax responsibilities on their own, promoting financial independence and facilitating growth.

Cost Efficiency

Understanding GST allows businesses to optimize tax credits and reduce tax liabilities, contributing to overall cost efficiency.

Industry Relevance

GST knowledge is highly relevant across various industries, making it a valuable skill applicable in diverse professional environments.

Real-time Application

Learning GST with practical examples allows for real-time application, ensuring effective implementation of concepts in professional situations.

Financial Management Skills

Individuals gain a better understanding of financial transactions, bookkeeping, and financial reporting through GST training.

Global Business Understanding

GST is an integral part of international trade and commerce, providing a global perspective on taxation principles.

Consultancy Opportunities

Acquiring expertise in GST opens doors to consultancy opportunities, where individuals can provide guidance to businesses and individuals.

Continuous Learning

As tax laws evolve, ongoing learning in GST ensures individuals stay updated with regulatory changes, improving their professional competence.

Entrepreneurial Ventures

Knowledge of GST is key for those starting their businesses, ensuring they navigate tax regulations effectively from the beginning.

Networking Opportunities

Joining the GST community provides networking opportunities, connecting individuals with professionals, mentors, and potential collaborators.

Personal Finance Management

Understanding GST principles can also benefit individuals in managing their personal finances and investments more effectively.

GST Course in Hyderabad

Market Trend

The market trends in Goods and Services Tax (GST) have been marked by a continued shift towards digitization and automation in tax compliance processes. Businesses and tax authorities alike have increasingly included digital platforms and tools to improve GST filing, return submission, and other compliance activities

01

Digital Transformation:

There is a growing trend towards digitalization of GST compliance processes, including online registration, return filing, and payment of taxes. Businesses are increasingly adopting GST-compliant accounting software and digital tools to improve tax compliance and reporting.

02

Compliance Complexity:

As GST regulations evolve and become more complex, businesses face challenges in ensuring compliance with changing requirements. There is a rising demand for expert GST consultants and advisors to help businesses navigate regulatory complexities and minimize compliance risks.

03

Focus on Technology: Technology-driven solutions such as artificial intelligence (AI), data analytics, and blockchain are being leveraged to enhance GST compliance, improve tax administration, and detect tax evasion.

04

Cross-border Transactions:

With GST being a destination-based tax, there is an increased focus on managing GST implications for cross-border transactions, including imports, exports, and international services. Businesses are adopting strategies to optimize GST costs and reduce compliance risks associated with international trade.

05

GST Rates and Classification: Changes in GST rates and classification of goods and services have a significant impact on businesses across various sectors. Market trends reflect a constant need for businesses to stay updated on changes in GST rates, exemptions, and notifications to optimize tax planning and pricing strategies.

06

Industry-specific Challenges:

Different industries face unique challenges in GST compliance due to sector-specific regulations and complexities. Market trends indicate a growing demand for industry-specific GST expertise, with specialized consultants catering to the needs of sectors such as e-commerce, real estate, and manufacturing.

07

Litigation and Dispute Resolution:

As GST laws continue to evolve, there is a rise in and disputes related to GST interpretation, classification, and compliance. Market trends reflect an increased demand for tax disputes experts and legal advisors specializing in GST dispute resolution.

08

Compliance Cost Optimization:

Businesses are exploring strategies to optimize compliance costs associated with GST, including improving processes, leveraging automation, and Strengthen internal controls. Market trends indicate a growing focus on cost-effective GST compliance solutions to improve business competitiveness.

09

GST Simplification Initiatives: Governments are increasingly focusing on simplifying GST processes and reducing compliance burdens for businesses. Market trends show a push towards integration of GST rates, rationalization of exemptions, and streamlining of procedures to enhance ease of doing business and promote economic growth.

FAQ’S

At Accounting Mastery, mastering GST is straightforward with clear explanations and practical examples, making complex concepts easy to understand for all skill levels. Professional guidance and user-friendly resources ensure confidence in navigating GST compliance effortlessly.

- Commerce background graduates

- Tax experts

- Finance professionals

- Entrepreneurs

- MBA professionals or aspirants

- Chartered accountants

- Startup agencies

You can enroll in our GST course in Hyderabad at Accounting Mastery Without considering previous programming experience, as our curriculum focus on taxation principles and compliance, ensuring accessibility for learners from all backgrounds.

Yes, we offer support in preparing for job interviews and help with updating resumes, which we then send to potential employers as part of our placement assistance.

The GST course in Hyderabad offered by Accounting Mastery is highly useful, preparing participants with essential knowledge and practical skills for navigating GST compliance effectively and advancing their careers in taxation or accounting fields.

Career in GST can be great, especially with Accounting Mastery’s course, which helps you learn important skills for working in taxes and accounting, opening up many opportunities for success in this field.

Studying GST helps us understand how taxes work, and with Accounting Mastery’s GST course, we can learn how to manage taxes better, which is important for businesses and individuals alike.