Business Accounting and Taxation Course in Hyderabad

- Expert Trainer with 18+Years of Experience

- Mock Interviews and Interview Questions

- Lifetime Access to our Learning Management System (LMS)

- 100% Placements Assistance with Certificate and Career Guidance

Table of Contents

ToggleBusiness Accounting and Taxation Course in Hyderabad

Batch Details

| Trainer Name | Mr. Varun Kumar |

| Trainer Experience | 18+ Years |

| Next Batch Date | 5th February 2024 – (10:00 AM IST) |

| Training Modes | Online Training (Instructor Led) |

| Course Duration | 45 Days |

| Call us at | +91 96034 33444 |

| Email Us at | |

| Demo Class Details | Click here to chat on WhatsApp |

Business Accounting and Taxation Course in Hyderabad

Curriculum

1.1 Overview of Accounting and Taxation

1.2 Importance of Accurate Financial Records

1.3 Historical Perspective of Accounting

2.1 Generally Accepted Accounting Principles (GAAP)

2.2 Accrual vs. Cash Basis Accounting

2.3 Double-Entry Accounting

3.1 Income Statement

3.2 Balance Sheet

3.3 Cash Flow Statement

4.1 Structure and Purpose

4.2 Creating a Chart of Accounts

4.3 Customizing for Business Types

5.1 Recording Transactions

5.2 Journal Entries

5.3 Ledger Maintenance

6.1 Sales Invoices and Receipts

6.2 Recognizing Revenue

6.3 Sales Tax Compliance

7.1 Tracking and Categorizing Expenses

7.2 Petty Cash

7.3 Employee Reimbursements

8.1 Importance of Reconciliation

8.2 Reconciling Bank Statements

8.3 Detecting Discrepancies

9.1 Calculating Gross and Net Pay

9.2 Deductions and Withholdings

9.3 Payroll Tax Compliance

10.1 Understanding Depreciation

10.2 Methods of Depreciation

10.3 Amortization of Intangible Assets

11.1 Basics of Taxation

11.2 Types of Taxes

11.3 Tax Planning Strategies

12.1 Filing Requirements

12.2 Deductions and Credits

12.3 Tax Compliance for Corporations

13.1 Individual Tax Returns

13.2 Taxable Income Calculation

13.3 Credits and Deductions for Individuals

14.1 Understanding VAT/GST

14.2 Registration and Compliance

14.3 Calculating and Reporting VAT/GST

15.1 Overview of Excise Duties

15.2 Customs Duties and Tariffs

15.3 Import and Export Documentation

16.1 Triggers for Audits

16.2 Preparation for Audits

16.3 Handling Investigations

17.1 Cross-Border Transactions

17.2 Transfer Pricing

17.3 Double Taxation Avoidance

18.1 Overview of Tax Software

18.2 Choosing the Right Software

18.3 Using Tax Software Effectively

19.1 Professional Standards

19.2 Handling Ethical Dilemmas

19.3 Consequences of Unethical Practices

20.1 Ratio Analysis

20.2 Financial Forecasting

20.3 Interpreting Financial Reports

21.1 Importance of Budgeting

21.2 Creating a Budget

21.3 Monitoring and Adjusting Budgets

22.1 Legal Structure of Businesses

22.2 Compliance with Business Laws

22.3 Contracts and Legal Obligations

23.1 Identifying Financial Risks

23.2 Mitigating Financial Risks

23.3 Insurance and Risk Transfer

24.1 Understanding Financial Statements

24.2 Making Informed Financial Decisions

24.3 Personal and Business Finances

25.1 Applying Knowledge to a Real Business Scenario

25.2 Analysis and Reporting

25.3 Presentation of Findings

Business Accounting and Taxation Course in Hyderabad

Key Points

Comprehensive Curriculum

Our course provides a comprehensive curriculum that covers all important areas of business accounting and taxation. This ensures that students thoroughly understand both basic principles and advanced concepts.

Expert Instructors

Learn from experienced industry experts in accounting and taxation. Our instructors bring a lot of knowledge and practical insights to the classroom, making the learning experience richer and providing valuable guidance.

Hands-on Learning

The Course involves hands-on learning where you can use what you have learned in real-world situations. By doing practical exercises, case studies, and simulations, you will build the skills and problem-solving abilities needed to succeed in accounting and taxation.

Interactive Sessions

Participate in interactive sessions led by our instructors that encourage lively discussions and teamwork with your classmates. This hands-on learning environment helps you stay engaged, think critically, and share knowledge.

Practical Assignments

Students will benefit from practical assignments that aim to strengthen their learning and enhance their skills. These assignments provide opportunities to practice accounting and taxation techniques in a supportive environment, with guidance from our expert instructors.

Professional Development Opportunities

Enroll in our Business Accounting and Taxation course in Hyderabad, Whether you want certifications, workshops, or networking with industry experts which includes placement support from our team.

What is Business Accounting and Taxation?

- Fundamentals of Business Accounting

- Business Performance Evaluation

- Principles of Taxation

- Budgeting and Forecasting

- Financial Management

- Compliance and Regulations

- Strategic Planning

- Cost Management

- Tax Planning Strategies

- Transparency and Disclosure Requirements

Business Accounting and Taxation Course in Hyderabad

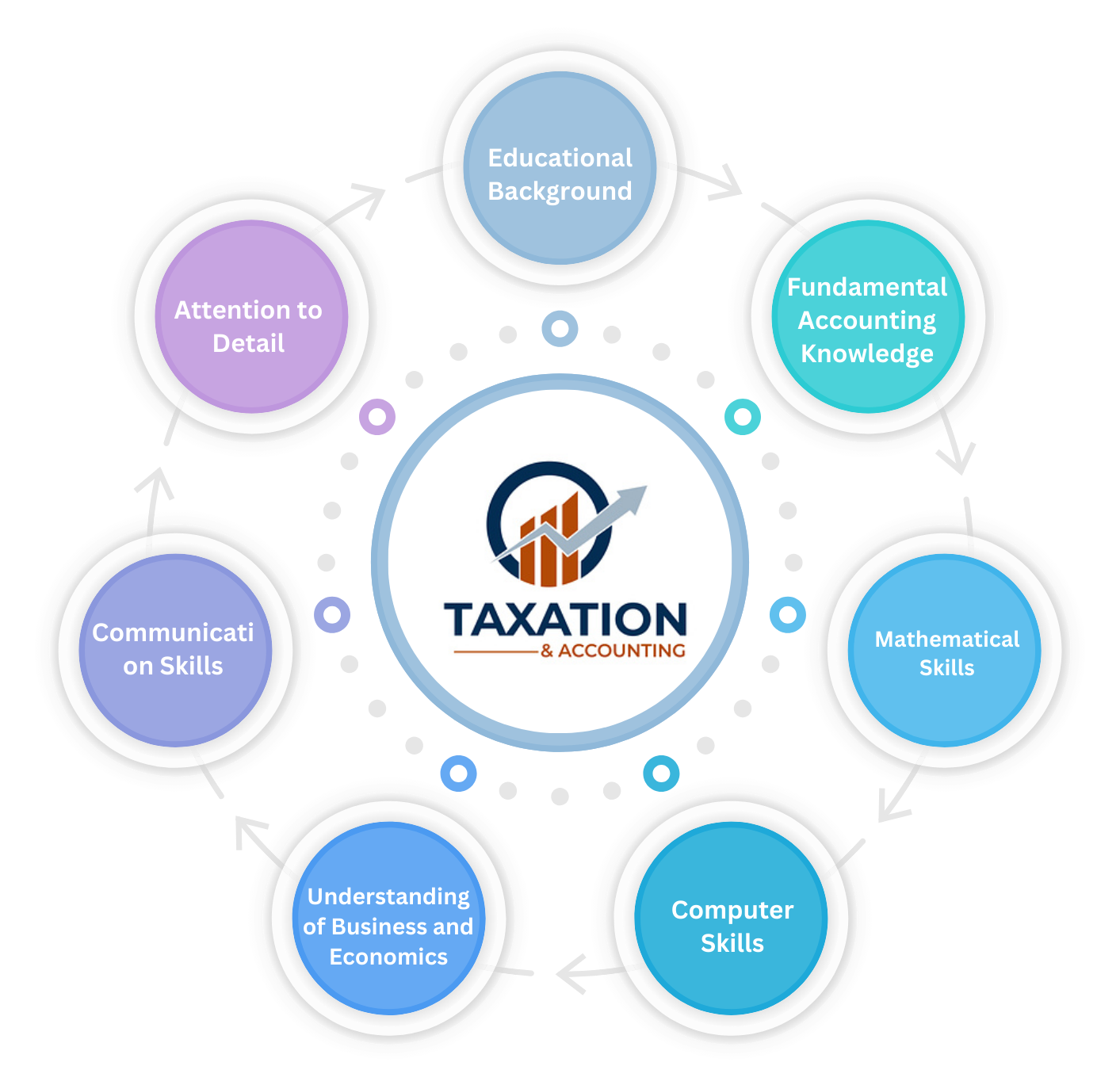

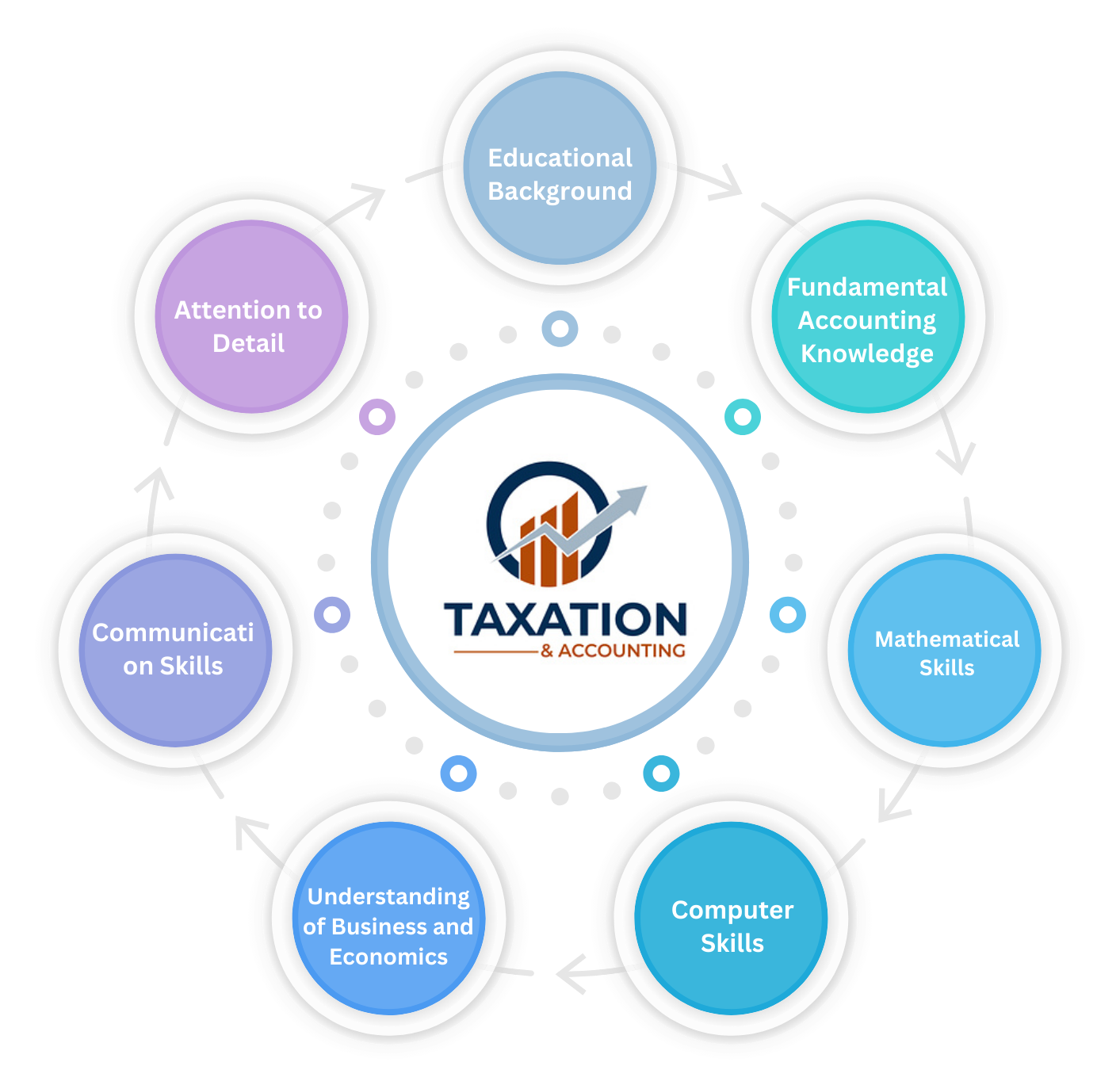

Pre-Requisites

- Educational Background: requires a bachelor's degree in accounting or a related field.

- Basic Skills: Proficiency in basic concepts is essential for understanding financial calculations and accounting principles.

- Computer Literacy: Knowing how to use computers and basic software is important because accounting and taxation often require using specialized software

- Legal and Regulatory Knowledge: Understanding of relevant laws, regulations, and accounting standards governing financial reporting and taxation helps ensure compliance and ethical conduct in business practices.

- Analytical Skills: Develop strong analytical skills to interpret financial data and make informed decisions, a crucial aspect of accounting and taxation.

- Legal and Regulatory Understanding: Understanding basic legal and regulatory concepts in finance and taxation helps to understand the overall context of business accounting.

- Problem-Solving Abilities: Capability to identify and address accounting and taxation challenges creatively and efficiently contributes to effective financial management and compliance.

Business Accounting and Taxation Course in Hyderabad

Course Outline

01

Introduction to Accounting Principles

Business Accounting and Taxation Course Contains fundamental concepts like the accounting equation and double-entry bookkeeping.

02

Financial Statements Analysis

Focuses on interpreting balance sheets, income statements, and cash flow statements for financial evaluation.

03

Budgeting and Forecasting

Techniques for budget creation, forecasting, and variance analysis to aid in financial planning.

04

Taxation Basics

Introduces fundamental tax concepts including taxable income and deductions.

05

Corporate Taxation

Explores tax planning strategies and compliance requirements for corporations.

06

Tax Planning Strategies

Techniques to minimize tax liabilities and optimize deductions.

07

Tax Compliance and Reporting

Covers filing requirements, record keeping, and reporting obligations.

08

Taxation and Business Decision Making

Examines how tax implications influence business decisions.

09

Case Studies and Practical Applications

Applies theoretical knowledge to real-world scenarios for hands-on learning.

Business Accounting and Taxation Course in Hyderabad

Couse Overview

Business accounting and Accounting taxation course in Hyderabad are essential components of financial management for companies. They play a critical role in maintaining accurate records, ensuring regulatory compliance, and supporting strategic decision-making.

In accounting, financial transactions are systematically recorded to produce key statements such as the balance sheet and income statement, which provide insights into a company’s financial health and performance.

These records are then analyzed to assess profitability, liquidity, and solvency, aiding stakeholders in making informed decisions. On the other hand, taxation involves understanding and adhering to tax laws, reporting obligations, and strategic tax planning to minimize liabilities while maximizing tax efficiency.

Ethical considerations are crucial in both accounting and taxation, emphasizing integrity, transparency, and compliance with legal requirements. By integrating accounting principles with taxation strategies, businesses can effectively manage their finances, optimize tax outcomes, and ensure ethical business practices.

Modes Of Training

Classroom Training

- Experienced Professional Instructors

- Personalized Guidance

- Interactive Learning Environment

- Practical Learning Approach

- Mock Interviews & Career Guidance

Online Training

- Experienced Professional Instructors

- Personalized Guidance

- Designed for Remote Learning

- Practical Learning Approach

- Mock Interviews & Career Guidance

Self-paced Video Training

- Structured Live Recordings

- Personalized Guidance

- Interactive Weekly Online Sessions

- Practical Learning Approach

- Mock Interviews & Career Guidance

Business Accounting and Taxation Course in Hyderabad

Career Opportunities

01

Accountant

Business Accounting and Taxation Course prepare financial statements, analyze financial data, and ensure compliance with accounting principles and regulations.

02

Tax Specialist

Provide tax planning, preparation, and compliance services for individuals and businesses to optimize tax outcomes.

03

Auditor

Conduct internal or external audits to assess financial operations, identify risks, and ensure compliance with regulations.

04

Financial Analyst

Analyze financial data, assess performance, and provide insights to support strategic decision-making.

05

Controller

Oversee financial reporting, budgeting, and accounting operations within an organization.

06

Tax Consultant

Offer specialized tax advice and planning services to businesses or individuals to minimize tax liabilities.

07

Budget Analyst

Develop, monitor, and analyze budgets to support effective financial management and resource allocation.

08

Financial Manager

Plan, revenue, direct, and coordinate financial activities within an organization, ensuring financial health and sustainability.

09

Financial Planner

Assist individuals or business in developing comprehensive financial plans, including tax strategies, investment management, and retirement planning.

10

Entrepreneurship

Start your own accounting or tax consulting firm to provide services to clients independently.

Business Accounting and Taxation Course in Hyderabad

Certifications

- Certified Public Accountant (CPA)

- Chartered Accountant (CA)

- Certified Management Accountant (CMA)

- Enrolled Agent (EA)

- Certified Information Systems Auditor (CISA)

- Certified Internal Auditor (CIA)

- Chartered Tax Professional (CTP)

- Certified Financial Planner (CFP)

- QuickBooks Certification

Testimonials

Business Accounting and Taxation Course in Hyderabad

Benefits

Financial Analysis

Enhanced ability to analyze financial data, interpret financial statements, and assess business performance.

Tax Planning

Proficiency in developing tax strategies, minimizing tax liabilities, and optimizing tax outcomes for businesses.

Budgeting and Forecasting

Skills in creating budgets, forecasting financial trends, and managing resources effectively.

Compliance Management

Understanding of regulatory requirements, ensuring compliance with tax laws and accounting standards.

Problem-Solving

Improved problem-solving skills in addressing accounting and taxation challenges creatively and analytically.

Communication

Enhanced communication skills, both written and verbal, for effectively send financial information and collaborating with stakeholders.

Critical Thinking

Developed critical thinking abilities to evaluate financial situations, identify opportunities, and make informed decisions.

Professionalism

Cultivated professionalism and credibility in handling financial matters and interacting with clients, colleagues, and regulatory authorities.

Time Management

Improved time management skills in prioritizing tasks, meeting deadlines, and managing work load effectively in a dynamic financial environment.

Business Accounting and Taxation Course in Hyderabad

Market Trend

01

Technology Integration

Increasing differences in cloud-based accounting software and automation tools for designed financial management, improving efficiency and accuracy in accounting and taxation processes.

02

Data Analytics

Business Accounting and Taxation Course growing focus on data analytics and business intelligence in accounting, most advanced analytics tools to extract data from financial data for better decision-making and strategic planning.

03

Specialization

Rising demand for specialized accounting and taxation services, such as forensic accounting, international tax planning, and sustainability reporting, reflecting evolving regulatory requirements and client needs.

04

Compliance Complexity

Increasing complexity in tax laws and regulations globally, driving the need for specialized expertise in tax planning, compliance, and risk management to ensure businesses remain compliant and reduce risks

05

Strategic Advisory Services

Expansion of accounting firms’ service offerings to include strategic advisory services, such as financial planning, mergers and acquisitions, and business consulting, to provide Integrated financial solutions to clients.

06

Virtual Currency and Blockchain

The emergence of virtual currencies and blockchain technology has led to new challenges and opportunities in accounting and taxation, with firms exploring innovative solutions to address regulatory and reporting requirements.

07

Remote Work Capabilities

The shift towards remote work arrangements has increased the demand for virtual accounting and taxation services, with firms offering flexible solutions to remote clients’ needs

08

Continuing Professional Development

Increasing focus on continuing professional development for accounting and taxation professionals to stay updated on evolving industry trends, regulations, and technologies, ensuring competency and relevance in the marketplace.

09

Globalization

The globalization of businesses has led to increased demand for international tax expertise, transfer pricing services, and cross-border compliance solutions to navigate complex international tax environments effectively.

FAQ’S

Accounting Mastery’s Business Accounting and Taxation course in Hyderabad provides you with essential financial management and tax compliance skills, opening doors to diverse career opportunities in accounting firms, businesses, and financial consulting. Join us to master accounting principles and taxation strategies for a successful career in finance.

Opt for our Business Accounting and Taxation course in Hyderabad at Accounting Mastery to gain vital financial management and tax compliance skills, setting you up for diverse career opportunities in finance. Join us to master accounting principles and taxation strategies for a successful professional journey. principles and taxation strategies for a successful professional journey.

Enroll in our Business Accounting and Taxation course in Hyderabad at Accounting Mastery to enhance your career prospects with essential financial management and tax compliance skills. Join us to gain expertise in accounting principles and taxation strategies for a successful professional

At Accounting Mastery, our Business Accounting and Taxation course in Hyderabad equips you with practical skills in financial management, tax planning, and compliance, ensuring you’re well-prepared for diverse roles in accounting and finance. Join us to master accounting principles and taxation strategies, setting a solid foundation for your career growth.

At Accounting Mastery, our Business Accounting and Taxation course in Hyderabad offers insights into financial management and tax planning, enriching your understanding of business operations and enabling informed decision-making for organizational success. Join us to master accounting principles and taxation strategies, enhancing your ability to contribute effectively to business operations.

At Accounting Mastery, our Business Accounting and Taxation course in Hyderabad equips you with practical skills in financial management, tax planning, and compliance, ensuring you’re well-prepared for diverse roles in accounting and finance. Join us to master accounting principles and taxation strategies, setting a solid foundation for your career growth.

At Accounting Mastery, our Business Accounting and Taxation course in Hyderabad equips you with practical skills in financial management, tax planning, and compliance, ensuring you’re well-prepared for diverse roles in accounting and finance. Join us to master accounting principles and taxation strategies, setting a solid foundation for your career growth.